Key points

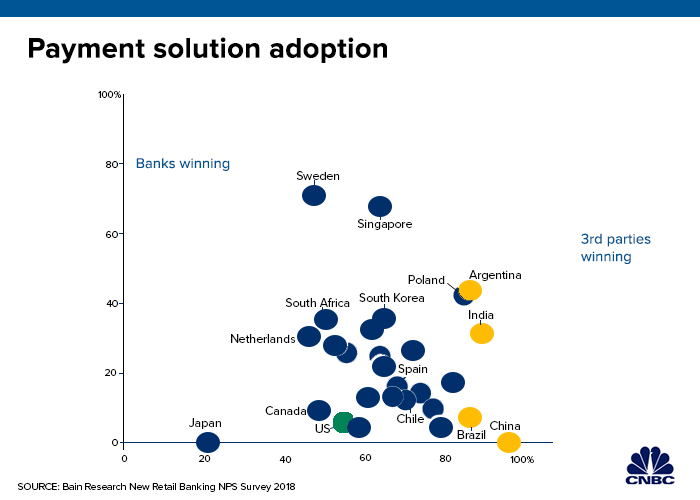

- Compared with China, India and other parts of the world, the U.S. is way behind in adopting mobile payments.

- It seems odd considering the ubiquity of smartphones in America. But experts say a deeply embedded legacy system and rewards cards make it unlikely that we’ll see a major shift anytime soon.

What’s going on here?

- Despite growing smartphone dependence, most Americans still aren’t using the devices to pay for things. In other countries, it’s a different story:

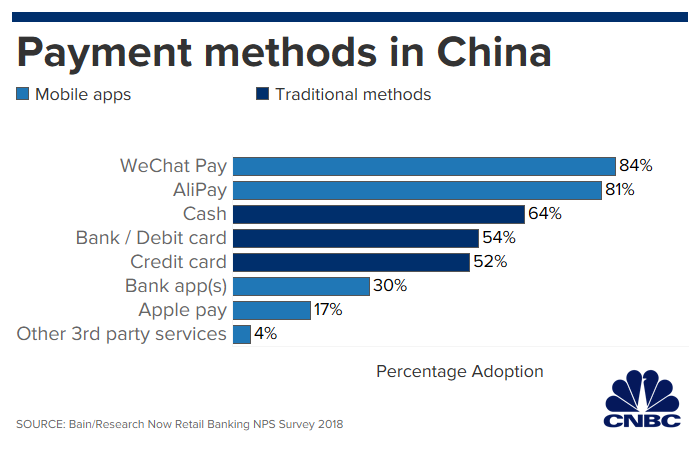

- In China, more than 80% of consumers used mobile payments last year;

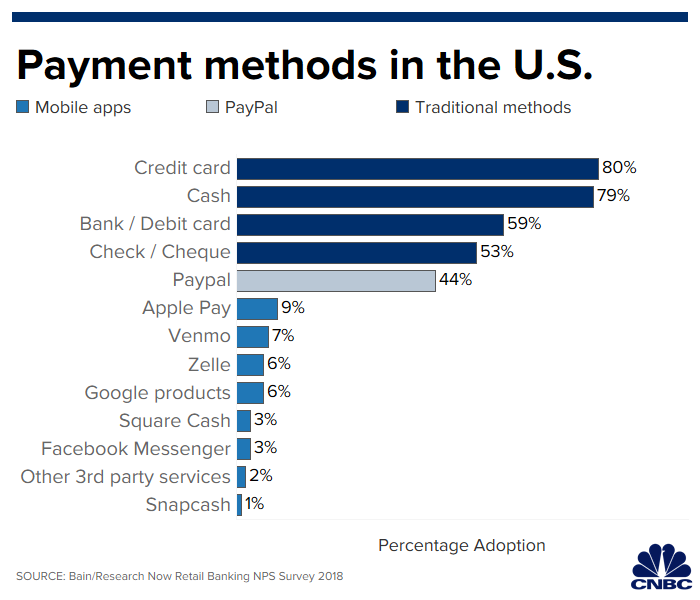

- In the U.S., major mobile payments apps had adoption rates of less than 10%, while more than 81% own a smartphone.

What does that mean?

‘Friction factor’

- One reason phones are the go-to payment method in some countries abroad is because they have been very cash-based economies — that has a pretty high hassle and friction factor

- Moving away from physical bills was a way to get more tax revenue since cash transactions often happen under the table. As a result, mobile payments took off “unbelievably fast”.

- China’s mobile-payment Renaissance was less a result of government intervention. Instead, tech giants Alibaba and Tencent began battling for customers’ wallets and eclipsed banks in the process. Because they deal with both merchants and consumers, there’s less of a need for credit cards to act as the middlemen.

- But in the U.S., the credit and debit card system is well-established and works just fine for most people. Cards are widely accepted, and sometimes it’s easier to swipe a credit card than to use digital device.

- The legacy players include Visa and Mastercard and the banks. Those players have a lot to lose if the status quo changes. The most likely outcome is that the economics involving banks and credit card companies will look the same, but the “cosmetics” and user experience will happen on a smartphone.

Merchant acceptance

- U.S. consumers aren’t lacking options when it comes to paying on their phones (Apple Pay, Google Pay, Samsung Pay, PayPal, …). But in order to use these apps, merchants such as coffee shops and retail stores need the proper hardware.

- Conventional methods are still winning in the U.S: 80% of consumers used credit cards for purchases last year. Merchants need to hit a certain threshold before even early adopters will consider switching entirely to mobile. At least 90% of acceptance to get even 1% of consumers to change a habit.

Rewards

Credit cards compete for customers with cashback and travel rewards — something people won’t readily give up. Mobile payments apps are catching on:

- With Starbucks, you use this to earn free coffee”. “That might not exist yet for Apple Pay or Google Pay.”

- Apple’s new credit card offers 2% in cash back on Apple Pay transactions, 3% for purchases made directly through Apple, and 1% on purchases with a physical card.

Fed opens up lanes

- A recent, real-time payment announcement from the Federal Reserve might also change the mobile-payment landscape. It announced a real-time payments system – FedNow that would

- make money transfers available almost immediately;

- enable more bank-like offerings from tech giants such as Facebook’s WhatsApp or even Amazon and Google.

The big picture

People don’t always want to pay for things immediately, in real-time. The borrowing aspect is still valuable, as well as the coveted rewards and points. Cards might just look like a “hybrid” version of their old models in mobile form, and in some cases embedded in the apps

Content source: Roony. K. (2019) Mobile payments have barely caught on in the US, despite the rise of smartphones. CNBC. Available from: https://www.cnbc.com/2019/08/29/why-mobile-payments-have-barely-caught-on-in-the-us.html [Accessed 1 September, 2019]