Summary

- Broadcom currently trades at a massive discount relative to its median 5yr price to free cash flow, granting investors an attractive entry point.

- “Chip stocks”, such as Broadcom can sometimes offer comparative yields to oil and gas stocks, while not facing mediocre returns at best and extinction at worst.

- The best chip stocks generate solid free cash flow for their investors.

Overview Of Chip Stocks; Why These Should Replace Oil And Gas Stocks In Your Portfolio

The dead of oil and gas stocks

If you’re a reader of the author (Stevens. L. at Seeking Alpha), you know that he believes oil and gas stocks will underperform the market over the coming decades until no company on earth generates their cash flows from fossil fuels. This idea is discussed in-depth in his article entitled, “XLE: Your Oil Stocks Are Dead Money“.

The substitute of Chip stocks

Semiconductor Stocks, aka chip stocks, are loosly applied to a variety of companies that engage in businesses such as the production and sales of processors, modems, memory storage, and a whole host of other computer-specific technologies found in everyday devices like smartphones and laptops.

Chip stocks largely handle commoditized products, whose prices can vacillate wildly, causing periods of boom and bust. Moreover, as is the case for oil and gas, many chip stocks produce products that are found in near perfectly competitive markets.

Chip stocks that generate FCF, or economic profits, are those that create efficiencies in their operations through effective management, M&A, and often, vertical integrations resulting from M&A. Broadcom possesses all three of these characteristics in spades.

Broadcom M&A case

Broadcom is a chip stock that combines two formerly separate entities, Avago and Broadcom, which boasts a highly diverse portfolio of products used primarily in communication devices. The stock is prominently featured in ETF’s such as the Philadelphia Semiconductor Index and the VanEck Vectors Semiconductor ETF.

Prior to Avago acquiring Broadcom, the two specialized in overlapping industries:

- Avago focused primarily on radio frequency filters and amplifiers used in high-end smartphones, in addition to solutions for wired infrastructure, enterprise storage, and industrial end markets.

- Legacy Broadcom targeted networking semiconductors, such as switch and physical layer chips, broadband products, and connectivity chips that handle standards such as Wi-Fi and Bluetooth. The company has acquired Brocade, CA Technologies, and Symantec’s enterprise security business to bolster its offerings in infrastructure software and security.

In a world where IoT has become a secular trend, Broadcom is poised to capture the financial windfalls of this trend over the coming decades through their robust portfolio of products.

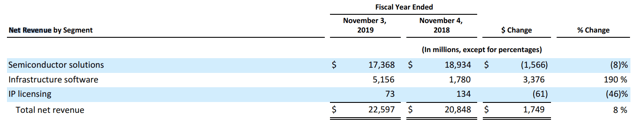

While Semiconductor Solutions have long been Broadcom’s bread and butter (76.9% of Revenue), in recent years they have begun diversification of their product lines that seem to fit within their goal of “connecting everything”. In light of their recent acquisition of Symantec, perhaps their new value proposition should be “connecting everything securely“.

Temporary Headwinds Creating Attractive Entry Point

- Huawei Ban

- Core Business Slowdown

- Global Slowdown

These three components are kind of the same headwind.

- Tensions between the U.S. and China have manifested as tariffs and the Huawei ban,

- Both have dented Broadcom’s financial performance.

- Moreover, in 2018, U.S. monetary policy created a scenario where a strengthening dollar

- weakened international sales, and

- sparked a global economic slowdown to some degree.

As a result, Broadcom’s valuation has been decimated as of late. In their latest annual report, published on November 4th, 2019, they did not mince words about the degree to which China plays a role in its revenue generation.

- In FY2019, approximately 35% of its net revenue came from shipments to China (including Hong Kong), compared to approximately 50% for both FY 2018 and 2017.

- The decline created their YoY revenue decline in their core Semiconductor Solutions business from 2018 to 2019:

Source: Broadcom's FY19 10-K

Despite this worrisome news, they followed with a comment that downplayed the impact that the China debacle might ultimately have in their FY19 10-K:

However, the end customers for either our products or for the end products into which our products are incorporated, are frequently located in countries other than China (including Hong Kong). As a result, we believe that a substantially smaller percentage of our net revenue is ultimately dependent on sales of either our product or our customers’ product incorporating our product, to end customers located in China (including Hong Kong).

Broadcom, as well as others who’ve bet the house on China, should take note of Apple’s moves to reduce their financial dependence on China. As of today, their numbers have demonstrated that a meaningful reduction in shipments to China isn’t too concerning.

Valuation

Broadcom’s valuation has taken a beating lately, and while the share price has held up relatively well, their valuation is at a decade low, which makes sense given their core revenues declining as stated above. However, the author views this as temporary, as the company finds new growth outlets, such as

- trends in cybersecurity, and

- the diversification of their revenue streams away from China.

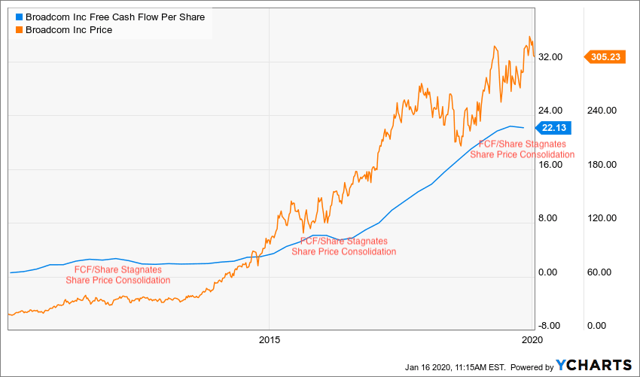

Broadcom is no stranger to the current trends in its FCF and the corresponding valuation the market decides to place on it. In the last two instances of FCF and valuation plateauing over the last decade, their share price has temporarily consolidated in lockstep with their stagnant FCF.

Source: YCharts

- In each of the prior instances, Broadcom guided that there would be stagnation, before re-acceleration of growth in FCF. We are currently in an FCF stagnation period with poor guidance coming from the company throughout 2019, and the share price has commensurately stagnated.

- All companies go through periods of ebb and flow apropos their FCF due to exogenous factors relative to the company and the U.S. or global economy.

Broadcom has experienced both of the above factors.

- Their FCF has been depressed due to their $15B acquisition of Symantec in 2019.

- Further, the ban on sales to Huawei has created uncertainty about the company’s growth prospects moving forward.

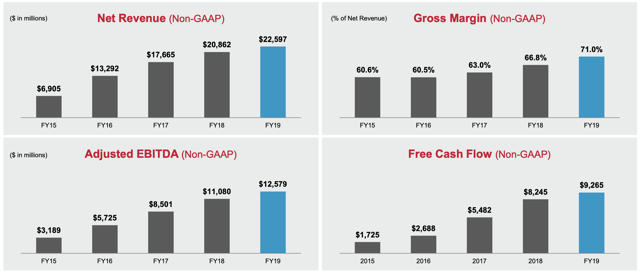

- Despite the Huawei ban and China trade tensions, Broadcom’s financial performance for FY19 was actually quite stellar. In the chart below, every financial component improved from 2018 to 2019.

Source: Broadcom Company Overview FY19

-

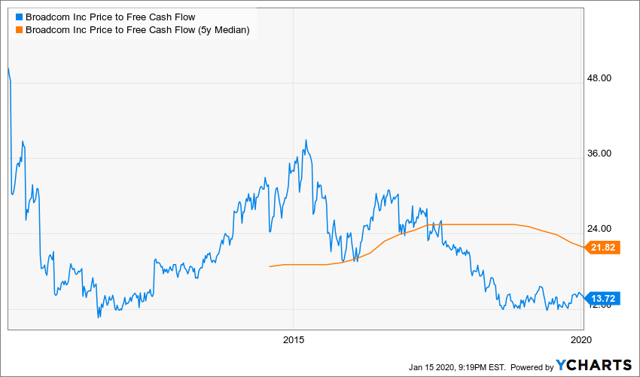

- Yet, their valuation has been absolutely decimated. Currently, their valuation rests at approximately 45% of their 5y median price to FCF. This happened in 2014, as well; after which, their margin exploded, multiplying 3 times to ~40x price to FCF.

Source: YCharts

-

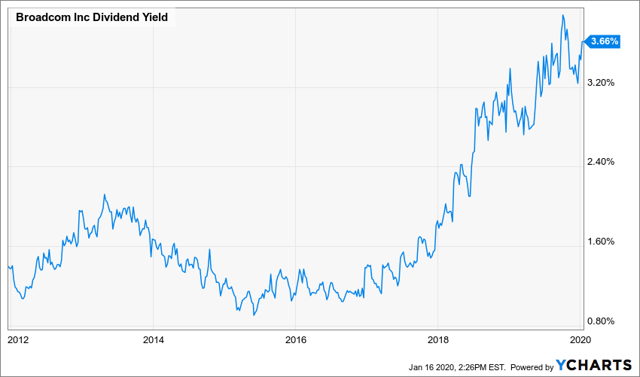

- This depression in price is further illustrated by their current dividend yield, which has never been higher.

Source: YCharts

-

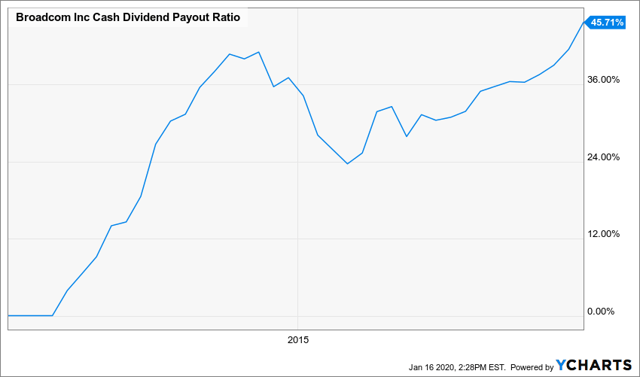

- And this dividend is secure, at about only 45% of their growing free cash flow.

Source: YCharts

Discounted Cash Flow Model

Over the last five years, Broadcom has grown its FCF per share by an annualized rate of 45.25%. While they have engaged in empire-building to some degree, their growth in FCF suggests that these acquisitions have been strategically intelligent.

- That is, the synergies or cost-reducing effects are borne out by their growth in FCF on a per-share basis.

What the author conservatively project

| Assumptions | Values |

| FCF to Equity Annual Growth (Past 5 yrs) | 45.25% |

| FCF to Equity Annual Growth (Future 10 yrs) | 10% |

| Terminal Growth Rate | 1% |

| FCF to Equity per Share | 22.13 |

| Discount Rate (90 year annualized return of SPY) | 9.8% |

| Fair Value | 482.19 |

Source: Data Compiled From YCharts

The author projected that Broadcom would only be able to grow its FCF by 10% for the next 10 years, which is believed to be conservative. In such a scenario, their fair value today would be $482.19, which means Broadcom is undervalued by about 58%.

What The Market Is Currently Projecting

| Assumptions | Values |

| FCF to Equity Annual Growth (Past 5 yrs) | 49.6% |

| FCF to Equity Growth (Future 10 yrs) | 3.5% |

| Terminal Growth Rate | 1% |

| FCF to Equity per Share | 22.13 |

| Discount Rate (90 year annualized return of SPY) | 9.8% |

| Fair Value | $302.88 |

Source: Data From YCharts

The market currently projects that Broadcom will grow its FCF at 3.5% over the coming decade, which is a bit unreasonable for a company that has grown its FCF at 45.25% over the last five years.

Concluding Remarks And Buy/Sell Recommendation

The headwinds that Broadcom faces are legitimate, though

- they do not pose an existential threat to Broadcom,

- nor should they be the reason for their massive undervaluation,

as:

- Huawei has been cited as making up approximately 4.3% of their revenues; therefore, the threat will ultimately be a blip on Broadcom’s radar as they set about on new strategic paths for growth.

- Further, the trade tensions and Huawei ban will actually prove to be positives for the company in the long run, as it has become the impetus for their revenue stream diversification.

Moreover,

- As for their financial performance, the market currently projects that they will grow FCF at 3.5%. That is simply a wild underestimation.

- Further, as the U.S. faces cybersecurity attacks from the likes of Iran, their emphasis on connecting everything securely seems as though it will pay off immensely in the future.

For all of these reasons, in the low $300s and below, Broadcom is certainly a strong buy!

Content source: Stevens. L. (2020) Broadcom: Oil Might Be Dead But Chips Are Just Getting Started. Seeking Alpha. Available from: https://seekingalpha.com/article/4317879-broadcom-oil-might-be-dead-chips-are-just-getting-started?isDirectRoadblock=true&utm_medium=email&utm_source=seeking_alpha&fbclid=IwAR1PZWBIcy27Dh_1B5b_rcNXBieHJl1w89OCqMVdfuy6eRNMKiSWLns4PjU [Accessed 27 January, 2020]