The M&A Takeover tactics

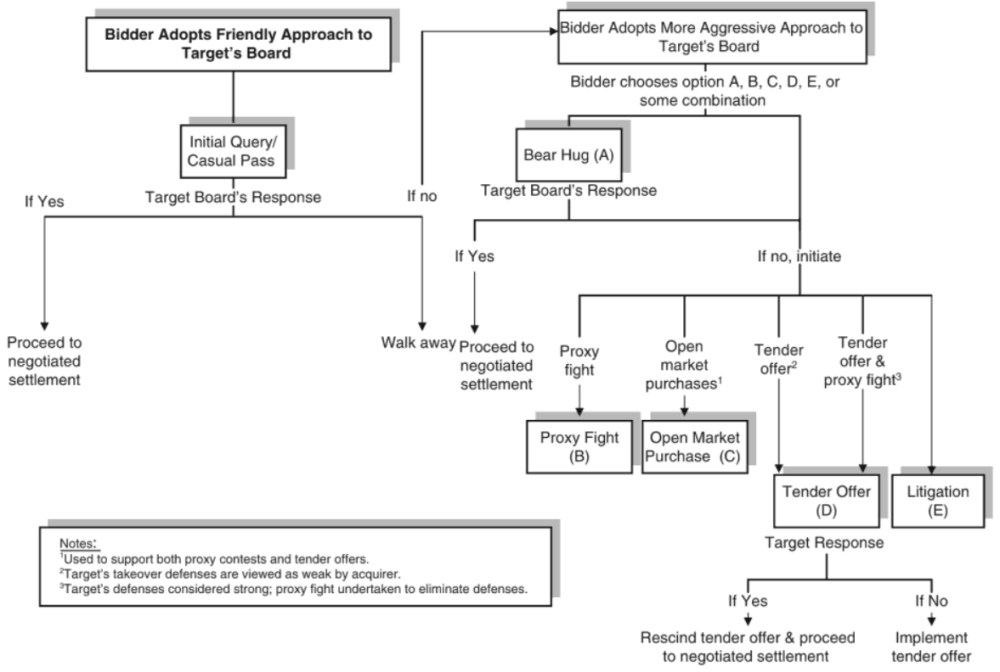

Although there are many facets to M&A and the industry is constantly evolving, it is important to understand the possible steps an acquirer would take in order to pursue a target business.

The early stages are considered friendly, and the latter hostile.

Donald DePamphilis, Mergers, Acquisitions, and Other Restructuring Activities. Available at: https://books.google.com.vn/books?id=yf_dqMSTj_MC&pg=PA103&lpg=PA103&dq=open+market+purchase+to+Proxy+contest&source=bl&ots=PEAvNiFSMU&sig=ACfU3U0kpCD9NYeSTx1doubY4wb3l6Ds3Q&hl=en&sa=X&ved=2ahUKEwidtafnnOnoAhUvG6YKHfvCBf0Q6AEwAHoECA0QJw#v=onepage&q&f=false [Accessed Apr 15, 2020]

Casual pass

- An informal inquiry made to business management; a solicitation to management to discuss “strategic alternatives” can be a suggestion for acquisition.

- A rejection would lead the acquirer to next steps considered hostile.

Bear hug

- A letter to company management regarding acquisition or demanding rapid response.

- Is often made public and utilized to encourage friendly negotiation.

Open market purchase

- The acquirer purchases shares in the open market

- Can often end up unsuccessful as a majority of shareholders are not willing to sell

- If successful, it could lower the overall cost of the transaction as one blanketed control premium is no longer negotiated.

Proxy contest

- The acquirer seeks to gain shareholders’ support to change the board of directors’ or management’s decision.

- Can be mailed out to garner support in the form of “votes”

Tender offer

- A direct solicitation to purchase shareholders’ share

- Is costly as a significant purchase premium is involved.

Litigation

- The most common type of litigation involves suits by stockholders seeking to enjoin or challenge a proposed M&A transaction based on the alleged unfairness of the transaction price, flaws in the process resulting in the transaction, and/or deficient disclosures relating to the transaction.

- Involves expedited proceedings in which the claims need to be decided before the challenged transaction is scheduled to close or be submitted to a stockholder vote, which can involve large teams of lawyers who have a significant amount of experience with M&A transactions and the related agreements

Raising Debt versus Raising Equity

It depends on varying forces, including market dynamics, but general trends can be simplified.

- When raising equity, the driver is the share price, which is related to the earnings (P/E) and the ability to raise equity in its current market environment, where IB come into play

- When raising debt, the interest rate is the underlying variable, and also its credit rating.

Raising equity is typically more dilutive than raising debt, but it depends on the company’s value and P/E:

- If the company is highly valued, it’s recommended to go out and raise equity for a much smaller amount of shares than average; vice versa

- Given the dilutive effects of raising equity, companies are often induced to raising debt, but it would have a potential impact on a company’s credit rating.

=> It’s the role of IB analyst to be able to build a model and understand the EPS accretion or dilution impact of each scenarios

How raising equity P/E

Mathematically, P/E is driven by the company’s EPS (1) and share price (2).

(1) EPS = Earnings (a) /No. of shares (b)

- (a) Assume Earnings stay the same.

- (b) Issuing more shares would decrease the number of shares outstanding.

As a result, EPS would decrease after the issuance.

(2) Share price

Unlike EPS, the share price is determined by the market. Here I categorize as supply and demand effects in an economic sense:

Supply: More shares are issued => Increase in Supply => Share price decreases

Demand: is more volatile as investors might have 2 directions of reaction. What investors want to know is what the company will do with the money raised from issuing shares to increase shareholder value.

- If the plan is to buy assets or even acquisitions that will significantly increase profitability, the stock price should go up.

- If the company is raising capital without a viable plan for the use of the money, the investing public may sell shares, driving down the stock price.

As a result, while diluting a share can quickly cause a drop in per-share value, this is just one possible outcome. What determines the P/E direction is the direction of the change of supply or demand of shares, and which one is stronger.

Content source:

1. Paul Pignataro. (2020) Mergers, Acquisitions, Divestitures, and Other Restructurings.

2. Tim Plaehn. (2019) What Happens to the Share Price When New Shares Are Issued?. Available at: https://finance.zacks.com/happens-share-price-new-shares-issued-7922.html [Accessed on Apr 15, 2020]