Summary of Vietnam Banks report by JPMorgan published on Dec 14, 2020

Investment thesis

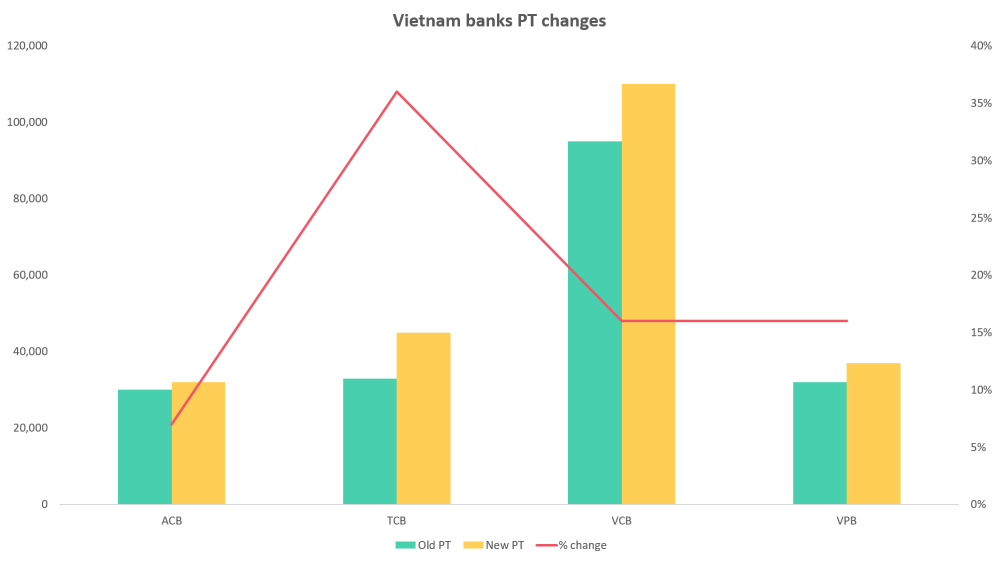

- Increasing EPS and PT

- EPS change: driven by lower provisions & higher volume growth thanks to higher GDP.

- PT increase: broadly following the EPS shifts.

- Foreign Ownership Limit (FOL) gap

- Banks have set at 22-23%, below the regulatory limit of 30%

- In case the Ministry of Finance’s draft guidance is adopted, foreign room in both stocks will be opened up

- Foreigners’ being allowed to take larger positions at market price is likely to drive volumes and re-rating.

- Loan Growth

- This year, the State Bank of Vietnam (SBV) expects credit growth of 8-10%

- Next year, credit quota is likely to be higher, potentially at mid-teens

- Banks with higher capital and better asset quality are expected to receive higher quotas

- Asset quality

- Slippages are limited given low restructured loans (1.3-8.1% of book)

Covered banks:

- TCB and VPB offer 72%/29% potential upside, with potential FOL changes as a key catalyst.

- VCB and ACB: re-rating has happened, led by EPS growth and book value compounding.

Investment summary

Macro

- Vietnam’s GDP resilience in 2020E, acceleration in 2021E

- Runway for growth from current account surplus

- Acceleration in EPS growth in 2021-22E

- Vietnam banks outperformed the rest of ASEAN by 30% YTD

ACB, TCB, VCB, VPB – specific

- ACB: shift to HOSE, insurance deal

- VPB: cash loan regulation, FE Credit potential IPO

- TCB: still significant upside to PTs (72%)

Thesis 1: Increasing EPS and PTs

- EPS change: driven by lower provisions & higher volume growth thanks to higher GDP.

- PT increase: broadly following the EPS shifts.

- Key risks:

- worse-than-expected slippages on asset quality

- weaker-than-expected volume growth

- macro risks; e.g: sequential waves of domestic COVID-19 outbreaks.

Increasing PTs

JPM’s EPS estimates for TCB and VPB are higher vs the Street

Lower credit costs expected in 2021-22E

Thesis 2: Foreign Ownership Limit (FOL) gap is a key driver

- Banks have set at 22-23%, below the regulatory limit of 30%

- In case the Ministry of Finance’s draft guidance is adopted, foreign room in both stocks will be opened up

- Foreigners’ being allowed to take larger positions at market price is likely to drive volumes and re-rating.

TCB and VPB are self-determining FOLs

Stocks at FOL have significantly lower foreign Average Daily Turnover (ADT)

Foreign share of trades are much lower at TCB, VPB, ACB

Thesis 3: Accelerating Loan growth

- This year, the State Bank of Vietnam (SBV) expects credit growth of 8-10%

- Next year, credit quota is likely to be higher, potentially at mid-teens

- Banks with higher capital and better asset quality are expected to receive higher quotas

TCB & VCB: Expecting high volume growth

TCB: highest capital adequacy ratio (CAR) in coverage

Possible higher quotas in 2021 due to low Non-performing loans (NPLs)

Thesis 4: Benign Asset quality

Slippages are limited given low restructured loans (1.3-8.1% of book)

Low restructured loans

NPLs remain manageable

NPL coverage over 100% by 2022, save for VPB

Reference:

1. JPMorgan Banks Report