The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

Transaction overview

- Indirect acquirer: ThaiBev – Thailand’s largest and one of SEA’s largest beverage companies

- Direct Acquirer: VietBev – founded in 2017 – the year the deal takes place

- Acquiree: Sabeco – a leading beer producer in Vietnam – listed in HOSE (ticker: SAB)

- Deal size: US$4.8b for nearly 345m SAB shares, equivalent of 53.59% ownership (majority) at VND320,000/share (biggest M&A deal in the history of Vietnam and the Asian beer industry)

- Official transaction date: Jan 04, 2018 (Report on the day becoming major shareholder)

Deal structure overview

- Thaibev, as a foreign investor, indirectly bought Sabeco through 4 intermediaries – 2 HongKong-based and 2 Vietnam-based companies.

- The remaining 51% of Vietnam F&B is owned by 2 other Vietnamese investors, who are (1) a business person in the same group as ThaiBev’s distributor in Vietnam and (2) ThaiBev’s local business consultant, who advised ThaiBev in relation to the Sabeco acquisition.

“One of the Vietnamese investors in Vietnam F&B is a business person [who] is in the same group as the Company’s distributor of alcohol beverages in Vietnam. The other Vietnamese investor is the Company’s local business consultant [who advised] the Company in relation to the [Sabeco acquisition].”

ThaiBev’s 22 December 2017 SGX filing

Why so complicated?

- According to Decree no. 58/2012/ND-CP issued in 2012 stipulating and guiding the implementation of the securities law, amended and supplemented by Decree no. 60/2015/ND-CP in 2015, the foreign ownership limit (FOL) of most businesses is 49% (exception are companies related to banking, securities, insurance area that meet certain conditions).

- Therefore, ThaiBev cannot directly purchase Sabeco, but must conduct the transaction through a legally dometic company (having foreign ownership of <51%), which, in this case, is Vietnam F&B. (read more of foreign investor conditions in Point 1, Article 23, Law on Investment 2014)

Risks involved

Details of this deal legality have not been disclosed, but 4 main risks are identified with the above transaction structure:

- The extent to which ThaiBev could control VietBev, with a 49% stake;

- The possibility that these Vietnamese investors sell their shares of VietBev to other investors / competitors;

- The possibility that VietBev, which is controlled by Vietnamese shareholders, sell Sabeco shares to other investors;

- The dividend payout ratio for Vietnamese shareholders in case VietBev receives dividends from Sabeco.

Risks (1)

It is likely that there is a legal agreement between the Vietnamese shareholders and Beerco, which allows Beerco to control VietBev. In addition, the increase of Vietnam F&B’s charter capital (from VND200m to VND681m) also allows Beerco to increase its control over VietBev through Vietnam F&B (explained in details below).

“As agreed with two Vietnamese investors in Vietnam F&B, the company, with its financial strength and good relationship, secured the initial financing to fund the Acquisition, with a plan to arrange for appropriate refinancing post-acquisition”

ThaiBev’s 22 December 2017 SGX filing

Risks (2)

VietBev was established as a multi-member limited liability company, so the sale of capital to other investors would be limited.

Except for [ ], every member of multi-member limited liability company are entitled to transfer part or all of his/her stake to another person as follows:

a) Offer the stakes to other members in proportion to their stakes in the company under the same conditions;

b) Only transfer the stake under the same conditions applied other members prescribed in Point a of this Clause to persons other than members if the members do not buy or do not buy completely within 30 days from the offering date.

Article 53 of 2014 Enterprise Law

In addition, it is likely that these Vietnamese shareholders invested in VietBev by taking loans from Beerco. Therefore, their shares in VietBev will be blocked and pledged to Beerco, thus limiting their ability to sell these shares to other investors. In specific, only when these Vietnamese shareholders pay off their loan with Beerco do their shares get released.

Risks (3)

VietBev’s charter capital is only VND681b, which is less than 1% of the transaction size (~US$4.8b). Therefore, it is likely that ThaiBev also lent VietBev the remaining amount for this deal to happen. In return, Sabeco’s shares are used as collateral for this loan. Thus, it is unlikely that VietBev would be able to sell their shares to other investors when more than 99% have been collaterized.

“Sabeco’ share to be acquired by Vietnam Beverage will also serve as strong and valuable collateral for the loan provided by Beerco to Vietnam Beverage”

ThaiBev’s 22 December 2017 SGX filing

Risks (4)

As mentioned above, VietBev borrows almost 99% of the transaction size from Beerco. Therefore, Vietbev has to pay loan interests to Beerco at a rate higher than the rate that ThaiBev pays to the banks sponsoring the deal. Thus, dividend payment is made only after VietBev has paid the interest amount. Consequently, the risk of dividends being distributed to Vietnamese shareholders is minimized.

“There will be interest chargeable on the loans by Beerco to Vietnam Beverage, which is higher than the cost-of-funds of Beerco”

ThaiBev’s 22 December 2017 SGX filing

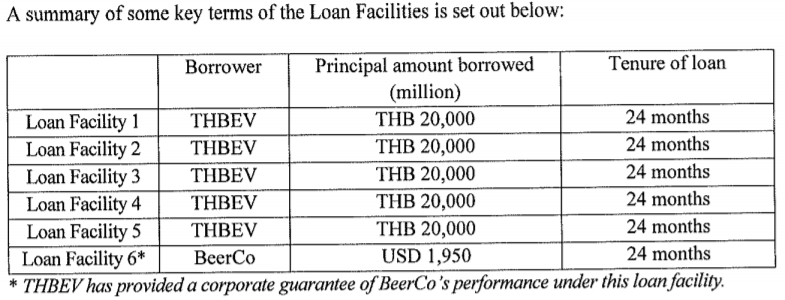

Loans to finance Sabeco’s share purchase have interest rates ranging from 2.4% to 3% and the loan term is 24 months

ThaiBev’s 2018 financial report

The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

Reference: https://www.trendinhphowall.com/post/m-a-ph%C3%A2n-t%C3%ADch-th%C6%B0%C6%A1ng-v%E1%BB%A5-thaibev-th%C3%A2u-t%C3%B3m-sabeco-p1

3 Comments Add yours