The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

Capital sources overview

- With a size of US$4.8b, the biggest M&A deal ever in Vietnam was funded by 5 loans from 5 Thai banks; ThaiBev also facilitated for Beerco to borrow US$1.95b from 2 other foreign banks.

- Interest rates on these loans range from 2.4% to 3%/year.

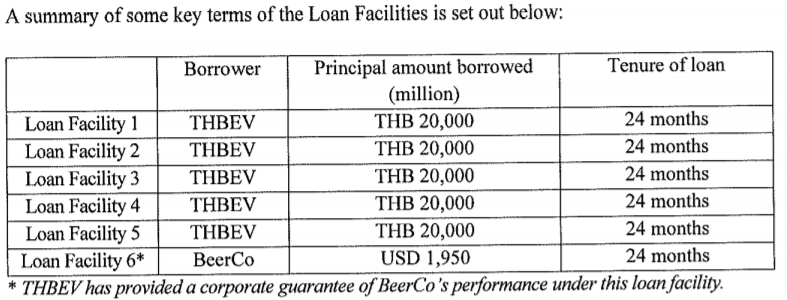

The company entered into bilateral facility agreements with each of Bangkok Bank Public Company Limited (“Loan Facility 1”), Bank of Ayudhya Public Company Limited (“Loan Facility 2”), Kasikornbank Public Company Limited (“Loan Facility 3”), Krung Thai Bank Public Company Limited (“Loan Facility 4”), and the Siam Commercial Bank Public Company Limited (“Loan Facility 5”) as a lender, and Beerco entered into syndicated facility agreement with Mizuho Bank, Ltd., Singapore Branch and Standard Chartered Bank, Singapore Branch (“Loan Facility 6”) as arrangers and lenders, pursuant to which loan facilities (the “Loan Facility”) as summarised below were provided to the Company and Beerco for the purposes of financing to the Aggregate Purchase Price and related transaction expenses.

ThaiBev’s 27 December 2017 annoucement to SGX

Capital structure

The noticeable detail is that all of these loans have a term of only 2 years. That raises the question of how ThaiBev would be able to repay such a huge amount in such a short time. 4 possibilities are present:

- Thaibev would use cash dividends that Sabeco would pay to repay the loans;

- ThaiBev would its own money to repay the loans;

- ThaiBev would sell its investment in Sabeco in 2 years to repay the loans;

- ThaiBev would refinance these loans with terms that match the payback period of the investment in Sabeco.

Possibility (1)

- The nearly VND110 trillion that ThaiBev spent to buy 53.6% of Sabeco’s shares was equivalent to a valuation of more than VND205 trillion for Sabeco. In 2017, Sebeco’s consolidated EBITDA was VND6,769b. This implied an EV/EBITDA multiple of 30x.

- Therefore, assuming a very optimistic annual EBITDA growth of 24.2% and dividend payout ratio of 100%, it would still take at least 10 years for ThaiBev to fully recover its investment (see details in part 3). Thus, the first possibility is infeasible.

Possibility (2)

The borrowing has caused ThaiBev’s credit ratings to be downgraded by several rating agency, for example:

- Moody’s issued a negative outlook, lowering ThaiBev’s credit rating from Baa2 to Baa3, which is the lowest level in the Investment Grade by Moody’s. According to Moody’s, the fact that ThaiBev’s loan for the deal has increased its 2018-forecast Adjusted-Debt-to-EBITDA ratio to nearly 4.8x, a strong increase. from Moody’s previous expectation of less than 2x

“The rating action reflects the significant increase in debt to fund a 53.59% stake in Sabeco we expect will drive ThaiBev’s consolidated adjusted debt/EBITDA close to 4.8x at year-end September 2018, representing a significant shift in the company’s financial risk appetite from our previous expectations of leverage remaining below 2x”

says Annalisa Di Chiara, a Moody’s Vice President and Senior Credit Officer

- Fitch downgraded ThaiBev’s credit rating from AA(+) to AA in Thailand and from BBB to BBB (-) in foreign markets, which is also the lowest grade in Investment Grade of Fitch. According to Fitch, ThaiBev loan for the deal has increased sharply its Fund From Operations ratio to 5.7x.

ThaiBev’s ratings have been downgraded by one notch following the debt-funded acquisition of Vietnam’s Saigon Beer – Alcohol – Beverage Corporation (Sabeco) on 27 December 2017. Fitch expects ThaiBev’s leverage, defined as FFO adjusted net leverage, to increase to 5.7x by the end of the fiscal year to 30 September 2018 (FYE18), from 1.2x at FYE17. However, leverage should decline to around 4x by FYE20, which will be in line with its ‘BBB-‘ rating

Despite the differences in methodologies applied by rating agencies, these ratios all reflect the time it’s likely to take for the rated institution to pay off its loans. Therefore, the ratios calculated show that possibility (2) is also infeasible.

Possibility (3)

- 53.6% of Sabeco’s shares were held at a public auction at HoSE and ThaiBev was the winner with the bidding price of VND320,000/share. However, ThaiBev was the only organizer to participate in the auction, while others had already given up. This showed that Sabeco’s offer price was not attractive to competitors.

- Morever, this deal is claimed to be a strategic acquisition, not for short-term investment purposes.

- Therefore, possibility (3) is unlikely.

Possibility (4)

Since the 3 possibilities above are all unlikely, possibility (4) is the only feasible option left.

ThaiBev disclosed that, due to the urgent auction time that left ThaiBev little time to make capital arrangement, they used Bridge Loan while pending another loan arrangement.

The timeline of the competitive offering was extremely tight, making it very difficult for bidders, including Vietnam Beverage, to secure external financing for the Acquisition.

ThaiBev’s 22 December 2017 SGX filing

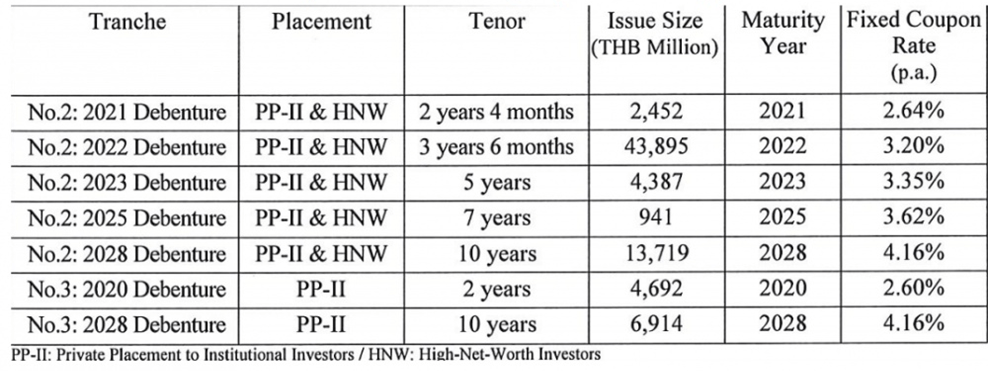

The loan refinancing took place not long after the deal completed. This refinancing involved debentures with multiple tranches corresponding to multiple terms and interest rates. In addition, all debentures issued were arranged by banks that provided the bridge loans themselves.

- In March 2018, ThaiBev issued debentures with a total value of ฿50b, equivalent to US$1.55b. This issuance involves 5 tranches, the weighted average maturity of which is 6 years.

- In September 2018, ThaiBev continued to issue another ฿77b of debentures, equivalent to US$2.39b. This issuance involves 7 tranches, the weighted average maturity of which is 5.3 years.

In total, ThaiBev had refinanced ฿127b, equivalent to US$3.94b, with a weighted average maturity of 5.6 years. This implied a debt ratio of 83% for the deal, representing a typical LBO deal.

The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

Reference: https://www.trendinhphowall.com/post/m-a-ph%C3%A2n-t%C3%ADch-th%C6%B0%C6%A1ng-v%E1%BB%A5-thaibev-th%C3%A2u-t%C3%B3m-sabeco-p2

3 Comments Add yours