The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

About ThaiBev

Business overview

- In FY17, ThaiBev’s consolidated financial results are as below:

- Revenue: ฿189,997b, ~ US$6.2b;

- Net profit: ฿22,799b, ~ US$746m;

- EBITDA: ฿32,675b, ~ US$1x.

- ThaiBev has four main business lines: (1) Spirits, (2) Beer, (3) Non-alcoholic beverages, and (4) Food.

- Spirits and Beer are backbonds of ThaiBev in terms of revenue and profit. Specifically, in FY17, Spirits and Beer respectively accounted for 57.5% and 30% of the group’s revenue.

Spirits business line

- Products: ThaiBev owns famous spirits brands in Thailand including Ruang Khao, SangSom, Mekhong, Hong Thong and Blend 285.

- Production:Thabev owns 5 whiskey factories in Scotland and 1 distillery in China.

- Distribution: ThaiBev’s whiskey products are distributed in 90 countries around the world, with the majority of revenue coming from European countries. Notably, ThaiBev dominates the Thai liquor market with a market share of more than 90% since 2000 (this dominance is related to the relationship between billionaire Charoen – ThaiBev’s biggest shareholder – and the President of Thailand; read more in “Thai Capital after the 1977 Crisis” by Pasuk Phongpaichit and Chris Baker, in chapter “Khun Charoen and the liquor industry through crisis and liberalization”)

- Financial results: With high margin, the Liquor line contributed to 90% of ThaiBev’s net income in FY17.

“In relation to the spirits business, even with increasing competition in the white spirits market, the Company still maintains its white spirits market share of over 90% with the production and sale of a wide range of white spirits’ brands and prices through focusing on nationwide distribution to cover the consumers with different purchasing power and maintain the Company’s existing consumer base.”

ThaiBev’s annual report 2017

Beer business line

- Products and distribution:

- Chang Beer is ThaiBev’s most famous beer brand with a market share of 35% in Thailand, second only to the brand Leo of Boon Rawd Brewery. Chang Beer is exported to more than 40 countries around the world, including the US and the UK. Notably, at the introduction of Chang, the brand Singha by Boon Rawd Brewery had already dominated the Thai beer market for nearly 60 years with a market share of more than 90%. However, in the context of the 1977-1979 economic crisis, ThaiBev pursued the low-price strategy that targeted the low-to-mainstream segment. Therefore, it took only 5 years for Chang Beer to take over that position with a market share of 60% in 1999. (read more in “A Study of the Beer Market Leader, Challengers and Niche Strategies” research by Sinee Sankrusme)

- ThaiBev also owns the brand Archa and the premium Federbräu.

Strategy

In Thai market:

- To consolidate its dominant position in Thai alcohol market, ThaiBev pursues the strategy of acquiring rival companies and manufacturing companies in the value chain.

- In 2006, ThaiBev acquired Pacific Spirits (UK) Limited, indirectly owning 5 Whiskey distilleries in Scotland.

- In 2009, ThaiBev acquired Yunnan Yulinquan Liquor Co., Ltd, indirectly owning the distillery in China.

- In 2011, ThaiBev acquired 64.66% of Sermsuk Public Co., Ltd, which owns the largest beverage distribution network in Thailand.

- In addition, to diversify the revenue streams, ThaiBev has also entered the non-alcoholic beverage and food market.

- In 2008, ThaiBev acquired more than 50% of Oishi Group Public Co., Ltd (“Oishi”) in 2008, which owns more than 239 Japanese restaurants in Thailand and is famous for its ready-to-drink green tea (RTD), Herbal tea and Crystal.

In SEA market:

- After establishing its strong position in the domestic market, ThaiBev continues to expand its influence into the SEA market by acquiring F&N Group, one of the largest beverage companies in Singapore and Malaysia. Although ThaiBev only owns 28.53% of F&N, the remaining 59.35% belong to a group of companies related to billionaire Charoen (TCC Assets Limited, Siriwana Company Limited, and MM Group Limited).

- ThaiBev has therefore set a 2014-2020 vision to become the leading beverage corporation in SEA. Thus, the acquisition of Sabeco is consistent with ThaiBev’s vision for this period.

“We aim to solidify ThaiBev’s position as the largest and most profitable beverage company in Southeast Asia.”

ThaiBev’s annual report 2014

Sabeco acquisition expectation

As mentioned in part 2, the EV/EBITDA multiple of ~30x of this deal shows ThaiBev’s huge ambition for Sabeco as:

- This multiple is 2 times higher than that of the overall Consumer Discretionary industry and 1.4 times higher than that of Sabeco’s direct competitor – Habeco;

- Sabeco’s EBITDA is expected to grow by 24.2%/year so that ThaiBev could break even in 10 years. Detailed calculation is as below:

Several aspects of Sabeco would be dug deeper to see if they could justify such an aspiring growth expectation:

- Vienam Beer industry growth;

- Vienam Beer industry competitive landscape (e.g: spare room to steal shares from competitors);

- Cost synergies with ThaiBev (e.g: management system improvement);

- Revenue synergies with ThaiBev (e.g: distribution of ThaiBev’s products through Sebeco’s channels, Sabeco’s real estate development through ThaiBev’s experience).

Sabeco’s standalone growth

Vietnam beer industry overview

- Before the transaction: According to Euromonitor, Vietnam’s beer market has a CAGR of 7.7% in the period 2010-2016. During this period, Sabeco’s sales volume also grew 6.5%/year, which was in line with the market growth.

- After the transaction: According to Euromonito, Vietnam’s beer market would have a CAGR of 6% in the period 2016-2020. Specifically, the mainstream beer segment is forecasted to grow a little faster at a CAGR of 7.1%.

- Assuming Sabeco can maintain its market share in the future and grow in line with the overall market, the 24% CAGR is unlikely to be expected from mere industry growth.

Vienam Beer industry competitive landscape

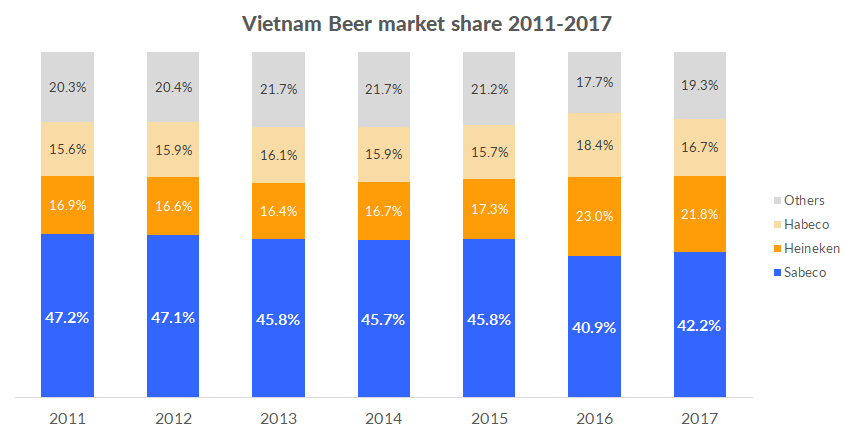

- At the end of 2017, Sabeco was still leading the market with a market share of 42.2%, 2 times that of Heineken (2nd-place) and 2.5 times that of Habeco (3rd-place). However, this was a sharp decrease from Sabeco’s share in 2011 (5%), which was gradually given to Heineken and Habeco.

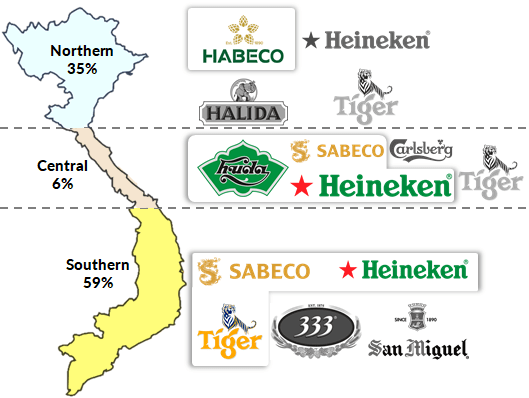

Geography

- Sabeco had concentrated in the South Central, Central Highlands and Southern regions. Therefore, the potential for expansion in the Northern region is quite large.

- Expansion in the Northern market would require investments in the distribution system. In that case, Sabeco would have huge advantages through:

- Phu Thai Group – one of the companies possessing the largest distribution network in the North. This group was acquired by Berli Jucker (BJC) of billionaire Charoen in 2015;

- The Metro Vietnam supermarket system with 6 supermarkets in the North and 4 supermarkets in the Central. This was acquired by TCC Holding of billionaire Charoen in 2014.

Price segmentation

In the Northern region, dominant players already mostly play in the affordable and mainstream segments. Therefore, in order to expand in this market, Sabeco could choose to either (1) tap into the premium segment or (2) compete directly in the mainstream segment.

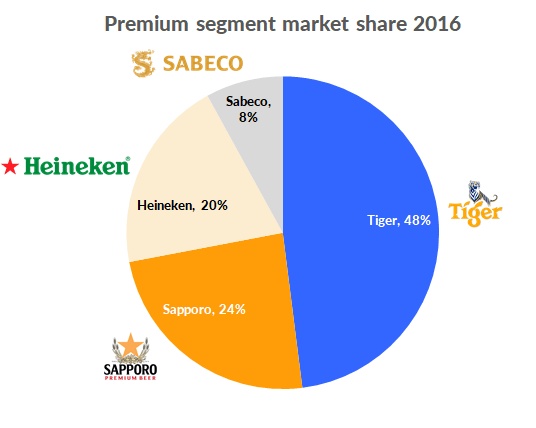

(1) Premium segment

- Heineken NV was leading the premium segment with more than 68% market share for 2 brands: Heineken and Tiger. Notably, Heineken also dominates the premium market in Thailand with 95% market share in this segment. Therefore, this segment is not an advantage of Sabeco or even ThaiBev.

- Moreover, expansion in this segment requires huge changes in product quality and brand image. This would likely last for a long time and lead to sharp increase in marketing and sales costs, thus squeezing profit margins. Therefore, this option is unlikely to increase Sabeco’s EBITDA by 24%.

(2) Mainstream segment

- The mainstream segment is the strength of Sabeco and ThaiBev, so it is more feasible to directly compete with rivals like Habeco in this segment.

- Moreover, ThaiBev could even acquire Habeco to realize this ambition.

- Context: As of 2017, Habeco was owned by the Ministry of Industry and Trade (82% ownership) and it plans to divest in 2017.

- However, this possibility is unlikely when Carlsberg had held 17.34% of Habeco since 2009 and held the priority to buy the shares offered by the Ministry of Industry and Trade (thanks to a cooperation agreement).

- Digging deeper, as of 2017, Carlsberg held a 9.7% market share, mainly in the Northern and Central regions. If Carlsberg successfully acquires Habeco, their total market share would be 26%, surpassing Heineken to take over the 2nd place. In this case, Sabeco’s expansion in the northern region and the mainstream segment would face even more difficulties.

All in all,

even in the most optimistic scenario that Sabeco would successfully expand in the Central and Northern markets with a 1% annual increase in total market share (equal to the annual market share increase of Heineken in the period 2011-2016, from 17% to 23%), Sabeco’s revenue would only grow at a CAGR of 16.3% in next 10 years.

Synergies

Cost synergies

- ThaiBev’s 3-year-average net margin and EBITDA margin for its beer bussiness was much lower than those of Sabeco. This implied that ThaiBev didn’t likely to have much more efficient cost management to offer to Sabeco. Therefore, cost synergies and margin improvement for Sabeco after the transaction are unlikely.

- Therefore, Sabeco’s EBITDA is expected to grow at a CAGR of only 16.3% (revenue growth), in the most optimistic scenario. This growth rate is still below the 24%-CAGR expectation.

Revenue synergies

Sabeco’s distribution network

- As of 2017, Sabeco owned the largest beer distribution system in Vietnam with 32,000 distribution points throughout the country through 11 trading companies and a joint venture company called Sabetrans (in which Sabeco has the largest share).

- ThaiBev’s ambition to bring its diverse product portfolios to Vietnam had been evident since the group made a series of acquisitions of distribution units in Vietnam prior to the 2017 Sabeco deal (e.g: Phu Thai Group and Metro, as mentioned above).

- Therefore, the acquisition of Sabeco would help ThaiBev strengthen the distribution system and thus its competitive advantage in Vietnam. However, it’s uncertain to calculate the exact value that this would bring.

Sabeco’s real estate business

- As of 2017, the total market value of real estate held by Sabeco was calculated to be VND8,410b.

- This value of real estate is expected to increase to VND56,579b in 10 years.

Combination

Even in the most optimistic scenario, combining total EBITDA that Sabeco could generate in the following 10 years and its real estate value at the time, a loss of ~VND41trillion is still expected from the investment.

In conclusion, the high price that ThaiBev paid to acquire Sabeco comes from Sabeco’s stand-alone growth prospects, the value of real estate, and the its wide distribution network. However, the estimated best-case return is far from the breakeven point. Time, therefore, has to pass to see if there are any underlying drivers that have not been analyzed here.

The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital bstructure, (3) Sabeco valuation, and (4) Divestment strategy

Reference: 1. https://www.trendinhphowall.com/post/m-a-ph%C3%A2n-t%C3%ADch-th%C6%B0%C6%A1ng-v%E1%BB%A5-thaibev-th%C3%A2u-t%C3%B3m-sabeco-p3-%C4%91%E1%BB%8Bnh-gi%C3%A1-sabeco 2. https://www.trendinhphowall.com/post/m-a-ph%C3%A2n-t%C3%ADch-th%C6%B0%C6%A1ng-v%E1%BB%A5-thaibev-th%C3%A2u-t%C3%B3m-sabeco-p3-%C4%91%E1%BB%8Bnh-gi%C3%A1-sabeco-ph%E1%BA%A7n-ti%E1%BA%BFp-theo

3 Comments Add yours