The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital structure, (3) Sabeco valuation, and (4) Divestment strategy

Sabeco’s perfomance 3 years after the transaction

Revenue

- Sabeco’s revenue increased by 5.1% in 2018 and 5.4% in 2019, but there was a sharp decline of 26.2% in 2020.

- This decrease largely came from:

- The issuance of Decree 100/2019/ND-CP on December 30, 2019 on administrative penalties for road traffic and rail transport offenses. Accordingly, the minimum alcohol concentration to fine traffic participants fall from 50 mg per 100 ml of blood to 0, which means only a drop of alcohol is enough to get fined. This has greatly discouraged people from drinking alcohol.

- The impact of the Covid-19 epidemic. Specifically, the ban on gatherings in big cities such as Ho Chi Minh City and Hanoi aused aggregate demand to decline significantly.

EBITDA

- EBITDA margin decreased to 16.9% in 2018, recovered to 19.4% in 2019, and increased impressively to 24.2% in 2020.

- Possible explanation for these results:

- In 2018, Sabeco’s input material price icreased sharply and excise tax rised from 60% to 65%. However, SG&A fell greatly, might be attributable to better cost management practices.

- In 2019 and 2020, the input costs of barley and aluminum reduced significantly.

Dividend payment

After 3 years, ThaiBev has received VND5,326b in cash dividends from Sabeco.

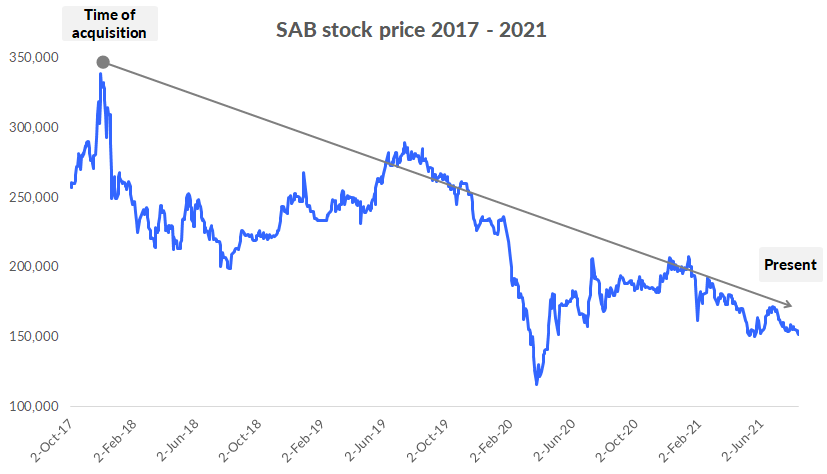

Stock performance

Compared to Sabeco’s share price of VND151,800 as of August 15, 2021, ThaiBev had to record a temporary loss of ~47% in the investment value.

ThaiBev’s financial position 3 years after the transaction

- Cash dividends from Sabeco were insufficient to service the loans financing this deal. In 2020 and 2021, ThaiBev has to use its own income to pay VND9,209b for loan interest and and principal repayment.

- Moreover, with Sabeco’s annual dividend payment rate ranging from 50-60%, it would be even more difficult for ThaiBev to depend on this source to service loans that are due from 2021 to 2028. Therefore, ThaiBev likely has to continue using its own money in the future.

- Consquently, ThaiBev’s debt ratios have also worsened significantly, which further downgraded ThaiBev’s credit ratings.

- For example, Fitch, despite maintaining the credit rating level, downgraded its outlook to negative in April 2020.

“We still expect ThaiBev’s net leverage, measured by funds from operations (FFO) to net debt, to stay high at above 4.0x, the level at which Fitch would consider negative rating action, in FY20-FY21, relying largely on the company’s organic recovery from the pandemic impact.”

Fitch’s update on ThaiBev on Apr 8, 2020

- Due to the high interest expenses, ThaiBev’s ROE of the beer business dropped significantly from 32.1% in 2017 to 2.3% in 2020.

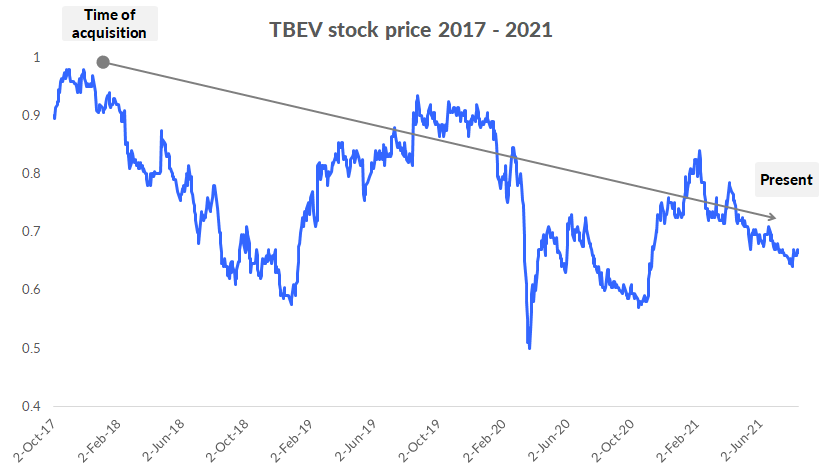

- The unsatisfactory results from the investment and the debts that ThaiBev has to bear have caused its investors to be dissatisfied. ThaiBev’s share price has dropped by more than 30% since the acquisition date.

ThaiBev’s possible next moves

To improve its financial position and performance, ThaiBev might consider some options as below:

- Refinance loans with longer terms and continue improving Sabeco’s operation to increase future profitability;

- Resell Sabeco shares;

- Issue more shares in the stock market.

Option (1)

- This option would still cause ThaiBev to continue being burdened with financial costs, and the extent to which Sabeco’s operation could be improved is still a big question mark.

- Therefore, this solution is only short-term and would even worsen ThaiBev’s credit rating and long-term position.

Option (2)

- Reselling Sabeco at the current low price means that ThaiBev would realize the loss for real. Moreover, adding a premium to the price is also not possible as the operation prospect is specially unclear in this period.

- Therefore, this solution is a “reluctant” choice in case ThaiBev has no better solution.

Option (3)

- This option would dilute existing shareholders’ share value.

- However, ThaiBev could minimize this dilution effect by conducting “Spin-off”. In specific, ThaiBev could separate their beer bussiness and raise capital for it.

All in all,

Among the 3 options above, option (3) would be the most suitable to help ThaiBev improve its financial position, reduce interest costs, and minimize shareholders’ negative effects. As a consequence, ThaiBev has announced the IPO of its beer business on the Singapore Stock Exchange in 2Q/2021. The expected capitalization of US$2b, equivalent to 20% of total capital.

“Thai Beverage had revived plans to list its regional beer assets through a Singapore IPO that could raise about $2 billion and that a listing could take place as early as the first half of 2021.”

Reuters reported on Jan 5, 2021

Conclusion

The largest M&A deal in Vietnam has caused ThaiBev’s financial position and performance to decline sharply, and ThaiBev might have to look for solutions to restructure its finance and beer business. Sometimes, the noise doesn’t make the name.

The analysis of this deal includes 4 parts: (1) Legal structure, (2) Capital bstructure, (3) Sabeco valuation, and (4) Divestment strategy

Reference: https://www.trendinhphowall.com/post/m-a-ph%C3%A2n-t%C3%ADch-th%C6%B0%C6%A1ng-v%E1%BB%A5-thaibev-th%C3%A2u-t%C3%B3m-sabeco-ph%E1%BA%A7n-cu%E1%BB%91i-chi%E1%BA%BFn-l%C6%B0%E1%BB%A3c-tho%C3%A1i-v%E1%BB%91n

2 Comments Add yours